Express Rubber Stamp, Company Chop Maker, Business Name Card, Sticker Printing and other Printing Services!

CUSTOM COMPANY RUBBER STAMP / COMMON SEAL

Add a touch of personalisation to create your very own rubber stamp or common seal for an added boost in company branding. We have taken great care in creating skillfully designed company stamp and company seal that can last for a long period of time. To help improve convenience, we have also taken steps to make sure that they are durable of the company chop is enough for you to bring them with you virtually everywhere without the risk of damaging them. What’s more, you could also make sure you’re sufficiently prepared by purchasing additional items like ink refills for your company stamp or seal stickers without having to go through the trouble of searching for another store that sells it.

normal rubber stamp

These classic stamps come in a variety of forms, with normal rubber stamps being one of the most common. They are produced to order according to the parameters you provide, and they have a wide range of applications. Stamps made from traditional rubber are available in a broad range of sizes, forms (including rectangular and round), and colors, allowing you to pick the stamp that is most suited to meet your requirements.

- Normal rubber stamps are an excellent choice if you want to produce bespoke stamp designs for your company or if you just want to add a personal touch to whatever you're working on.

- Sizes can vary (ranging 7 x 22mm up to 99 x 157mm).

- They can be used for different professions, small businesses, accountants, and postal services.

- They are the most affordable stamp types for individuals, companies, business divisions, and legal services.

Company Stamp and Seal

Company seals and stamps used by businesses are constructed from long-lasting materials, which enables them to survive for a very long time and produce thousands of clear impressions over many years.

You have complete control over the content, but we strongly suggest that at the very least your stamp should contain the name of your firm, its address, and the numbers associated with its company registration and VAT registration. Before placing an order, you should consult your legal counsel or an import/export agency if you have any questions.

Typically, these corporate stamps are excellent for certain legal purposes, including approval of papers, deeds, and company agreements to ensure authenticity and legality.

- Pocket Size (35mm) and about 370 grams in weight.

- Customers have the option of receiving common seals that have already been built or that have been taken apart for their convenience.

- Red or gold stickers of a common seal may be bought depending on your preference.

- The artwork size for the table-type seal may be either 36 or 48 millimeters in diameter.

- The diameter of a typical company stamp/seal is 35 millimeters. Check out for details in sizes.

SELF INKING STAMP

Stamps made of rubber that can ink themselves are by far the most common kind used today. They can be readily reinked, and their information can even be changed if it ever becomes outdated. Personalization options for custom stamps include a signature, a return address, or even a corporate logo. The applications are almost limitless as a result of this product's adaptability as well as the extensive range of sizes it is available in.

The ink pad is an integral part of every single one of the self-inking rubber stamps that are available. When you apply pressure to the top of the self-inking stamp, the die plate, which is where your information is located, rotates to face the paper so that it may make contact with it. As soon as you let go of the rubber stamp, the plate flips over and comes to rest on the ink pad. It is then primed and ready for the subsequent usage of the stamp.

You can find:

- Instant Round and Rectangle Self Ink Stamps

- Instant Key Chain Self Ink Stamps for Kids, Nurses, Teachers.

- Rectangle Pocket Stamps with Self-Ink Feature

- Round Pre or Self Ink Stamps start at 10 mm artwork diameter and go up to 50 mm artwork diameter.

- While Rectangle self-inking stamps come in different sizes (9 mm- 85 mm X 36 mm – 125 mm).

- Simple to use, and it can make up to a thousand impressions before it has to be refilled.

- The ink is durable and waterproof for the best possible impressions.

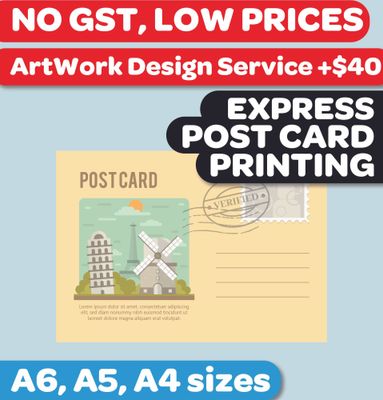

DIGITAL PRINTING SERVICE

Get business necessities like letterhead, envelope printing, name card, sticker printing, flyer printing and more with the help of Kiasu Printing & Rubber Stamp Maker (Singapore) Pte Ltd, who offers quality printing services in Singapore at budget-friendly pricing rates such as business card. You can expect quite a sizable range of printable material options to choose from, flexible shipping delivery options and short turnaround times when you choose to customise them here.

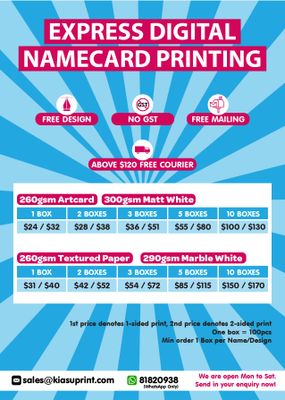

CUSTOMIZATION & PRINTING OF PROFESSIONAL QUALITY NAME CARD

Mix and match between our growing list of popular finishing effects and printable materials for your name card printing today! To better balance between the costs of printing business card and costs for achieving quality standards for our clients, we have taken steps to ensure that the prices we quote are free from hidden charges. With a minimum of 200 pieces (2 boxes), you can gain so access to so many interesting options to experiment around with.

LARGE FORMAT PRINTING SERVICE

Kiasu Printing & Rubber Stamp Maker (Singapore) Pte Ltd is also one of the most affordable companies to offer large format printing services in Singapore. If you’re looking to print something in poster size or customise your own pull up banners, PVC banner printing and large stickers for events, we’ve got you covered! Try out our pull up banner or poster printing options and have them created according to requirements today!

CONTACT DETAILS

Kiasu Printing & Rubber Stamp Maker (Singapore) Pte Ltd

Address: Blk 53 Ubi Avenue 1, #03-19 Paya Ubi Industrial Park, Singapore 408934

Telephone: 6100 0938

Email: sales@kiasuprint.com

Whatsapp Order: 81820938